A few years back several sources reported that the average US family that held private health insurance was roughly $17,000 + in medical debt verse the uninsured of $26,000+ (estimates). Health insurance coverage is an extremely major issue for individuals and families dealing with medically challenged children or adults.

Understand Your Policy

Reading an insurance policy is like reading a 2,000 page document to sign a bill into law…a foreign language almost. You will have to become familiar on the benefits your policy will cover or not cover. You as the parent or caregiver are the biggest advocate for your children or yourself. Take time to read these documents. The information will lessen the headaches later on. You need to know a few things:

- – Who is covered under what circumstances

- – Which services are excluded or included. What are the limits on the period covered

- – Who enforces the policy such as provisions and handles the appeals process

Additional information on understanding your policy

Ask For a Case Manager

Asking for a case manager will reduce some headache for you. You will have one contact at your insurance company that will get to know your circumstances personally and help expedite any claims. It is like having your own personal assistant working at the insurance company for you. It is important to be clear and concise with this person when communicating with them.

Never take just a “No”

Insurance companies make a regular practice of turning down coverage requests. They know most people will give up and become overwhelmed by the process. Just remember that the first time you’re turned down that it isn’t the last straw. Persistency will take you far but you have to develop patience with this process. Working with your case manager will come in handy.

Additional Resources

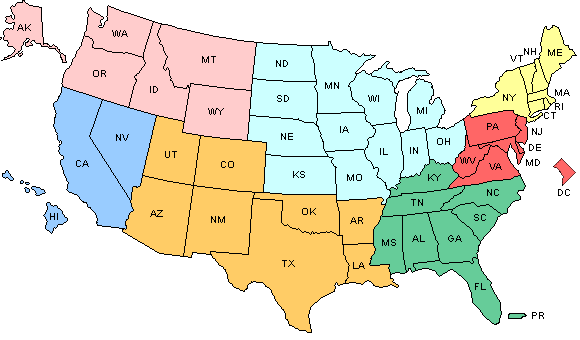

Check out consumer guides to getting and keeping health insurance by state.